On top of that, you may not be able to withdraw additional funds that you paid over the set amount either. Intend to learn more concerning the various real estate financings available in Malaysia? Right here is a quick run-down of the different residence funding products-- basic term, semi flexi and also complete flexi car loan-- being provided by banks to ambitious home buyers. Supplying you with the flexibility to take out funds whenever you need to, a flexi loan is hassle-free and can be settled much more easily. It operates as a reusable line of credit as well as offers you the choice to pay back the car loan at no additional price. For people who seek a strategic way to manage their financial resources as well as month-to-month expense, a flexi lending may offer you with alternate methods to control your spending plan.

- The loan can be shut before the tenure finishes by pre-paying the arrearage, in instance you have extra funds.

- You can just negotiate online, and obtain and deposit funds, with our client portal-- Experia.

- With this tool, you can cut your regular monthly spending by approximately 50% and also liberate funds for other expenditures.

- These kinds of financings allow the borrower a lot of affordability and adaptability, as there is no demand to invest substantial interest rates on extra money.

He/she can choose to take out funds whenever and as often times as required. Besides, the borrower additionally has the choice to repay the loan according to ease if he/she has surplus money in hand. This is to inform that, several instances were reported by public where fraudsters are cheating public by mistreating our trademark name Motilal Oswal. Though we have actually submitted complaint with police for the safety of your money we request you to not drop prey to such defrauders. You can inspect regarding our product or services by seeing our website You can likewise contact us at, to recognize more regarding product or services. For taking a Flexi funding, the consumers do not need to offer any separate files due to the fact that while opening the savings account, the customer currently submits all the necessary papers.

Pros Of Standard Term Loan

Send the necessary papers either online or to the rep of your loan provider when he/she contacts you. Marginal paperwork is needed for disbursal of the funding such as ID proof, address evidence, earnings proof, etc. The banks will verify your details and documents. We will certainly have addressed some of the standard inquiries such as personal details on your application for you. By continuing to make use of the website, you are accepting the bank's privacy policy. The info gathered would be made use of to enhance your web journey & to customize your web site experience.

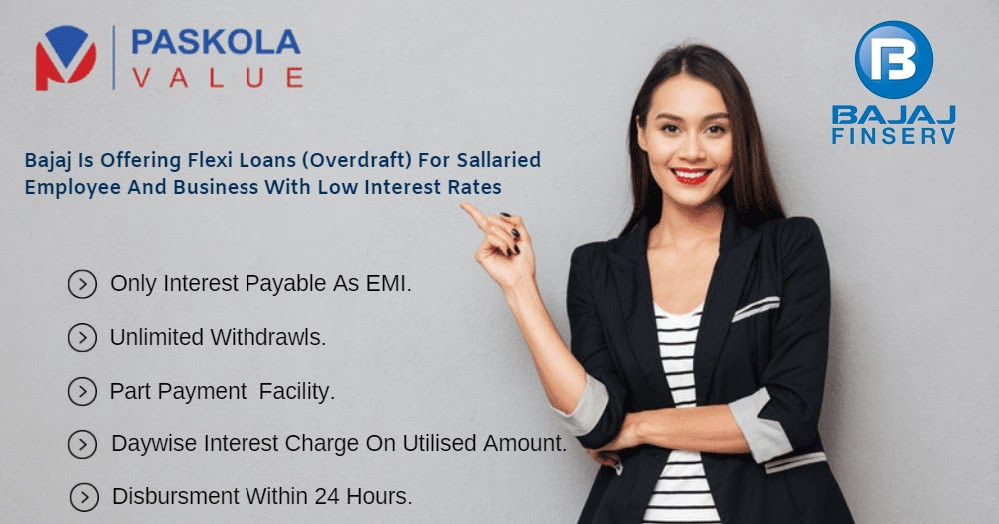

What Are The Benefits Of A Flexi Financing? Find Out

Please keep in mind that in case you withdraw the get more info additional amount paid previously, the interest that you saved on will certainly be chargeable. Flexi loan borrowers are likewise based on a fixed month-to-month fee of around RM5 to RM10. While the cost is negligible, it's still an added cost in addition to your regular monthly mortgage repayment. Flexi loans aren't offered at the majority of banks in Malaysia either, so it can be hard to search for the best flexi lending prices. Additionally, the rates of interest for full-flexi lendings can be fairly more than the ones provided by term finances. While a regular personal lending has a collection repayment timetable and the rates of interest could be lower, selecting a flexi individual funding does have its advantages.

Initially, Allows Recognize The Principles Behind The Standard Term Loan As Well As Rate Of Interest Calculations For Residential Or Commercial Property Car Loans

You can do this conveniently viaLoanCare, iProperty's Home Loan Eligibility Device. As an example of this joint partnership, the financial institution will at first have a holding of 90% over the building. However as time advances and your payment rises, it will certainly lower its shareholding, dropping to 80%, 70% and more up until the factor where the complete lending is settled. This is referred to as the Musyarakah Mutanaqisah sort of Islamic financing. We will certainly examine your company efficiency to determine the amount you can access and likewise to compute the rate of interest that will certainly apply. Our loan officers will certainly aid you understand the deal and make the very best choice.