Table of ContentsThe 5-Minute Rule for What Is The Coupon Bond Formula In FinanceWhich Of These Describes A Bond Personal Finance Can Be Fun For Anyone

Those who issue bonds can afford to pay lower rate of interest and still sell all the bonds they require. The secondary market will bid up the rate of bonds timeshare names beyond their face worths. The interest payment is now a lower percentage of the initial price paid. The result? A lower return on the investment, hence a lower yield.

Bond financiers pick amongst all the various kinds of bonds. They compare the threat versus reward provided by rates of interest. Lower interest rates on bonds mean lower costs for things you buy on credit. That consists of loans for vehicles, business expansion, or education. Most important, bonds affect home mortgage rate of interest.

When you purchase bonds, you lend your cash to an organization that requires capital. The bond provider is the borrower/debtor. You, as the bond holder, are the lender. When the bond develops, the issuer pays the holder back the initial amount obtained, called the principal. The provider likewise pays regular fixed interest payments made under an agreed-upon time duration.

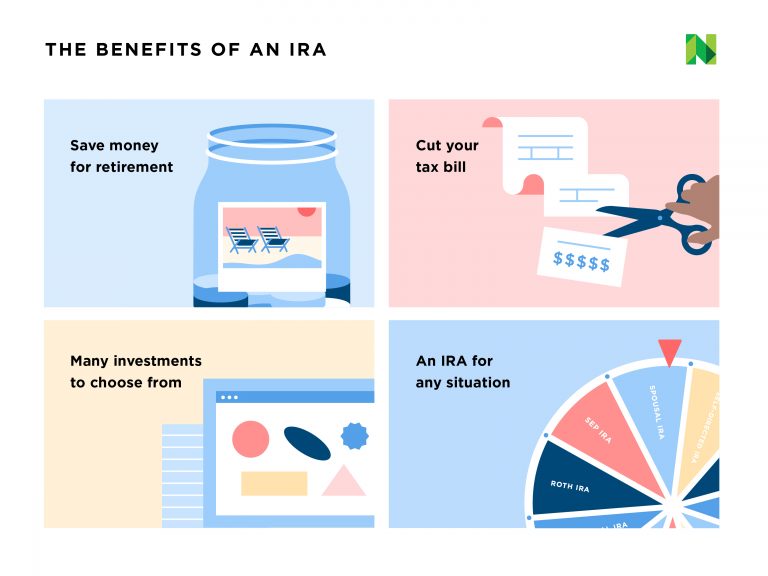

Bonds as investments are: Less dangerous than stocks (a city could issue which type of bond?). So, these deal less return (yield) on investment. Ensure these are backed by excellent S&P credit ratings. Enabled to be traded for a higher price. The best time to secure a loan is when bond rates are low, because bond and loan rates go up and down together.

Bonds are debt and are issued for a period of more than one year. The US government, regional federal governments, water districts, business and many other kinds of institutions offer bonds. which of these is an element of a bond personal finance. When an financier buys bonds, he or she is providing money. The seller of the bond agrees to repay the principal amount of the loan at a specified time.

Fascination About How To Calculate Nominal Rate On Treasury Bond Intro To Finance

A security representing the financial obligation of the business or federal government providing it. When a business or government problems a bond, it borrows cash from the bondholders; it then uses the cash to invest in its operations. In exchange, the shareholder gets the primary quantity back on a maturity date stated in the indenture, which is the arrangement governing a bond's terms.

Generally speaking, a bond is tradable though some, such as cost savings bonds, are not. The rates of interest on Treasury securities are thought about a benchmark for interest rates on other debt in the United States. The greater the rate of interest on a bond is, the more dangerous it is most likely to Click here for more info be - what is the symbol for 2 year treasury bond in yahoo finance.

The most standard department is the one between corporate bonds, which are provided by personal business, and government bonds such as Treasuries or local bonds. Other typical types include callable bonds, which permit the company to pay back the principal prior to maturity, denying the shareholder of future discount coupons, and drifting rate notes, which bring an interest rate that alters from time to time according to some criteria.

A long-term promissory note. Bonds vary widely in maturity, security, and type of company, although many are offered in $1,000 denominations or, if a community bond, $5,000 denominations. 2. A written obligation that makes an individual or an institution accountable for the actions of another. Bonds are debt securities provided by corporations and governments.

The company likewise assures to repay the loan principal at maturity, on time and in full. Since a lot of bonds pay interest on a regular basis, they are also explained as fixed-income investments. While the term bond is utilized generically to describe all financial obligation securities, bonds are specifically long-term financial investments, with maturities longer than 10 years.